Planning a road trip or need a rental car for a short period of time? It’s important to have reliable insurance coverage and Bonzah is a popular car rental insurance provider that offers adequate coverage and benefits. It offers various rental car insurance coverage options to ensure that customers are fully protected against loss or damage at cheap rates. Read this Bonzah review to find out if it’s worth your money and what sets it apart from other insurance options.

In this Bonzah review, we look at everything about Bonzah rental car insurance – from perks to drawbacks. With this, you can make an informed decision whether to choose Bonzah or not.

Table of Contents

What is Bonzah Rental Car Insurance?

If you’ve ever rented a car, you’re familiar with the hassle of choosing the right rental car insurance to protect yourself in case of accidents and theft during your rental period. This is where Bonzah rental car insurance comes in. It provides you with the freedom and convenience to purchase rental car insurance coverage for your upcoming travels.

Bonzah was founded in 2010 aiming to solve the problem of high premiums and fees charged by rental car companies on car renters for even the slightest damage. Over years, the Bonzah team has provided damage insurance to thousands of travelers all over the US and the world.

With Bonzah, you can select and pay for the coverage that you need prior to booking your rental car:

- Four coverage options. You can select from various coverage options for your upcoming automobile rentals. These include Damage Cover, Renter’s Contingent Liability Coverage, Supplemental Liability Insurance, and Personal Accident and Personal Effects Insurance.

- No deductible. No deductible is necessary upon claiming a liability insurance. However, Bonzah’s damage cover has a $500 deductible.

- 10-day free look. You can cancel your purchased coverages within 10 days, especially if you did not push through with the trip or filed a claim.

- All eligible drivers are covered. All coverage options by Bonzah rental car insurance apply to drivers with the following criteria: 21 years of age or older, have a valid driver’s license, and are added to the rental agreement upon car pickup.

What are the coverage options of Bonzah Rental Car Insurance?

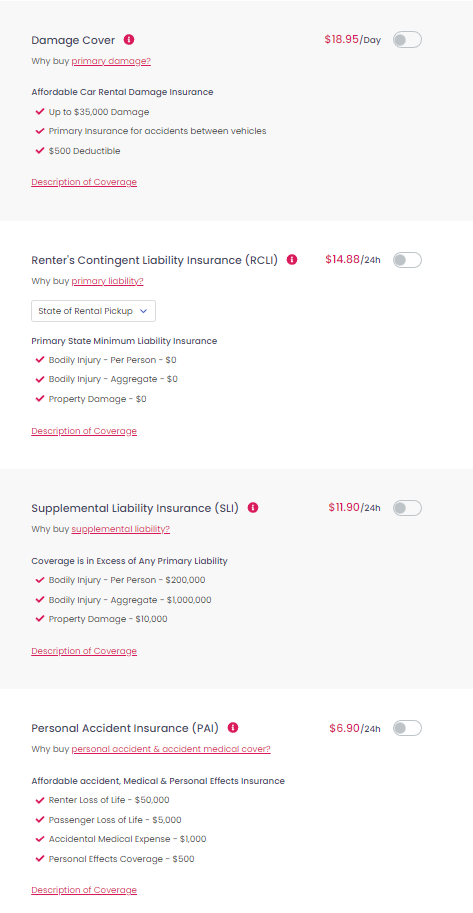

Bonzah rental car insurance offers basic coverage options – Primary Damage Cover, Renter’s Contingent Liability Insurance (RCLI), Supplemental Liability Insurance (SLI), and Personal Accident & Effects Insurance (PAI/PEI).

If you decide to avail all the coverage options, it will cost you $52.63 in total daily. However, you can freely select any coverage option suitable for your needs in your upcoming car rentals.

Primary Damage Cover at $18.95/Day

Primary Damage Cover is a low-cost car rental damage insurance policy that will decrease out-of-pocket repair costs. Moreover, it protects your family with proper rental collision coverage. It also can safeguard your personal auto policy from rising collision rates. You can integrate collision damage cover with other types of coverage, such as RCLI, SLI, and PAI/PEI.

You can only avail of this coverage option if you are traveling more than 50 miles from your residence.

Bonzah Car Insurance, however, limits primary damage cover to the following vehicles: standard 4-seater and 8-seater cars, SUV/pickup trucks of any size, and low-end exotic/luxury cars.

Consequently, high-end exotic/luxury cars, off-road vehicles, motorbikes, trucks, trailers, recreational vehicles, vintage cars, limousines, and commercial vehicles are not covered.

Coverage

- Covers only accidents between vehicles.

- Maximum limit of $35,000 for the damage to rental cars.

- A required deductible of $500.

Exclusions

- You, as the renter, violated any provision of the rental agreement.

- You, as the renter, used any vehicle not covered by Bonzah Car Insurance.

- The driver of the vehicle is not listed on the rental agreement as an authorized driver.

- You, as the renter, have any insurance similar to the primary damage cover, except for the renter’s personal automobile policy.

- You, as the renter, failed to follow the appropriate claims reporting procedures.

- A single-vehicle collision occurred.

- You, as the renter, used the rental car in motorsport or motor racing competition or practice.

- You, as the renter, was driving under the influence of alcohol or drugs, whether prescribed or not.

- You, as the renter, used the rental car while committing any unlawful acts.

- You, as the renter, used the rental car as a for-hire.

Renter’s Contingent Liability Insurance (RCLI) at $14.88/Day

RCLI works in place of a primary automotive policy in case you do not have one. If an accident occurs, the insurance limits will correspond to the minimum financial liability in the respective jurisdiction. RCLI only covers you, as the renter, authorized drivers and other entities declared in the rental agreement.

Coverage

- Conditions:

- The bodily injury or property damage results from an accident involving a rental vehicle.

- The accident occurs while the rental agreement is in effect.

- You, as the renter, elect the RCLI at the origin of the rental agreement.

- Primary State Minimum Liability Insurance for one accident (except for American Samoa, Guam, Northern Mariana Islands, Other Territory, Puerto Rico, and US Virgin Islands):

- Bodily Injury – Per Person: $10,000 to $50,000

- Bodily Injury – Aggregate: $20,000 to $100,000

- Property Damage: $5,000 to $25,000

Exclusions

- You, as the renter, failed to pay the charges owed under the conditions of the rental agreement.

- You, as the renter, used the rental car to participate in any speed contest, to drive while under the influence of drugs or alcohol, and to drive the car beyond the geographic limits mentioned in the rental agreement.

- The driver of the vehicle at the time of loss is not a renter or additional driver named in the rental agreement.

- You, as the renter, obtained the rental car through deception or fraud.

Supplemental Liability Insurance (SLI) at $11.90/Day

SLI protects you and any authorized driver, as indicated in the rental agreement, from third-party automobile claims for bodily injury and property damage sustained while using the rental car.

The amount of valid and collectible insurance you currently have (if any) will reduce the available protection under the SLI. You should know that SLI will only work as an excess liability insurance.

Coverage

Coverage is in excess of any valid and collectible insurance in effect, against third-party automobile claims for bodily injury and property damage during the permitted use of rental or shared vehicle.

- Bodily Injury – Per Person – $200,000

- Bodily Injury – Aggregate – $1,000,000

- Property Damage – $10,000

Exclusions

- You, as the renter, violated the terms/conditions or use restrictions of the rental agreement.

- SLI does not cover renters or authorized drivers that are uninsured and underinsured and with liability insurance that can be optional, waived, or rejected.

- You, as the renter, failed to accept any of the coverage during the effectivity of the rental agreement.

- You, as the renter, failed to pay the charges due.

- You, as the renter, obtained the rental car through misrepresentation.

- SLI does not cover fines, penalties, and punitive or exemplary damages.

- SLI does not cover any bodily injury not connected to any vehicular accident during the rental period.

Personal Accident & Personal Effects Insurance (PAI/PEI) at $6.90/Day

Personal Accident Insurance (PAI): This covers you, as the renter, and your immediate family with 24-hour accident protection for death when traveling in the rental car during rental period. PAI only covers passengers that are inside, boarding, or exiting the designated vehicle during the incident.

Accident Medical Insurance (AMI): This gives $1,000.00 in 24-hour accidental medical expenditure coverage for you, your passengers, and your immediate family while in, boarding, or alighting from the selected vehicle for emergency medical bills and ambulance fees.

Personal Effects Insurance (PEI): This policy provides limited coverage for your personal possessions in case of theft, damage to, or an accident involving your rental car. Personal Effect Coverage reimburses you for the actual monetary value of your belongings, subject to certain limits, deductibles, limitations, and exclusions.

Coverage

Affordable accident, Medical & Personal Effects Insurance

- Renter Loss of Life – $50,000

- Passenger Loss of Life – $5,000

- Accidental Medical Expense – $1,000

- Personal Effects Coverage – $500

Exclusions

- You, as the renter, violated the terms/conditions or use restrictions of the rental agreement.

- You, as the renter, failed to accept any of the coverage during the effectivity of the rental agreement.

- You, as the renter, failed to pay the charges due.

- You, as the renter, obtained the rental car through misrepresentation.

- PAI/PEI does not cover fines, penalties, and punitive or exemplary damages.

- PAI/PEI does not cover any self-inflicted bodily injury or any bodily injury not connected to any vehicular accident during the rental period.

How to File a Claim in Bonzah Car Insurance?

To file a claim, you can send all necessary documents to claims@bonzah.com. All claims must be filed as soon as the incident or accident giving rise to the claim has been identified. All losses must be reported within 30 days of the date of loss.

The following are the necessary documents:

- Claim form specific for the coverage option you purchased before the rental period (e.g., primary damage, RCLI, SLI, PAI/PEI)

- Incident report

- Notice of Loss

- Rental agreement

- Vehicle registration

- Driver’s license

- Police report

- Photos documenting the incident, if possible

- Report of estimate of damage

What are the Pros & Cons of choosing Bonzah Rental Car Insurance?

Choosing Bonzah for your travel insurance has both advantages and disadvantages. As part of due diligence, you may find a detailed list below. Finally, it is up to you to analyze the benefits and drawbacks and decide whether Bonzah is your best travel insurance provider.

Pros:

- Wide range of coverage. Bonzah provides a wide range of coverage options, such as primary damage, theft protection, and liability insurance. This means you can customize your insurance policy to match your particular needs.

- Affordable prices. Bonzah offers affordable costs that are often much lower than those of rental automobile providers. This can help you save money on car rental costs.

- No deductible. Bonzah provides insurance with no deductibles. This implies that if you need to file a claim, you will not have to pay any out-of-pocket expenditures. However, Bonzah now added a $500 deductible to its primary damage cover option.

- Easy to purchase. Bonzah’s insurance products may be acquired online in a matter of minutes, so that you can get the coverage option you want easily.

- Good customer service. Bonzah rental car insurance has a reputation for offering exceptional customer service. The customer support team has friendly and competent employees ready to assist you with any inquiries or problems.

Cons:

- Limited coverage for long-term rentals. Bonzah Car Insurance may not provide appropriate coverage for long-term rentals since its policies are primarily geared toward short-term rentals.

- Limited coverage for high-value vehicles. Bonzah’s policies have limitations that may not be enough for high-value rental cars. Therefore, you may need to obtain additional insurance coverage if you rent a luxury car or high-performance vehicle.

- No coverage for certain types of damage. Certain sorts of damage may not be covered by Bonzah’s insurance plans. For instance, damage to the rental car’s undercarriage is not covered, which might be costly to repair.

- Limited coverage outside of the US: Bonzah’s insurance policies are only valid within the United States. Therefore, you’ll need to obtain different insurance if you rent a car in another part of the world.

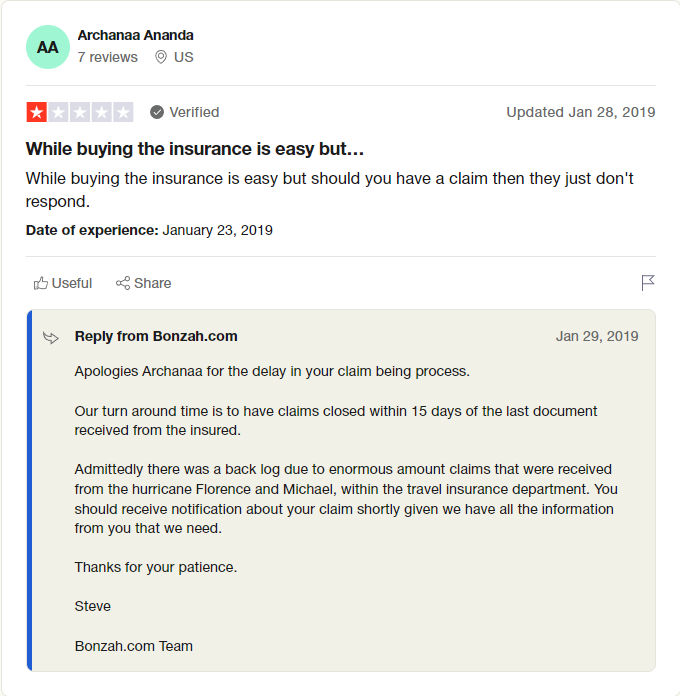

- Claims process can be slow. Bonzah’s customer service is generally excellent. However, the claims process might be tedious and inconvenient if you need to file a claim immediately.

What do users say about Bonzah Car Insurance?

Bonzah Car Insurance has gained popularity among users due to its affordability, wide coverage options, and easy online purchasing process. Thus, customers can tailor their insurance policies to fit their needs and save money on rental car expenses.

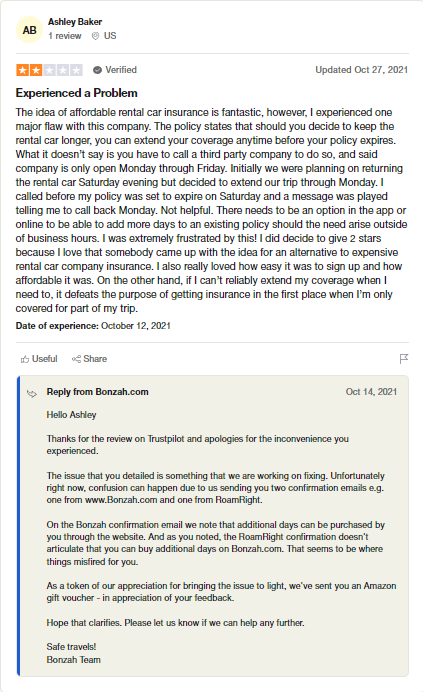

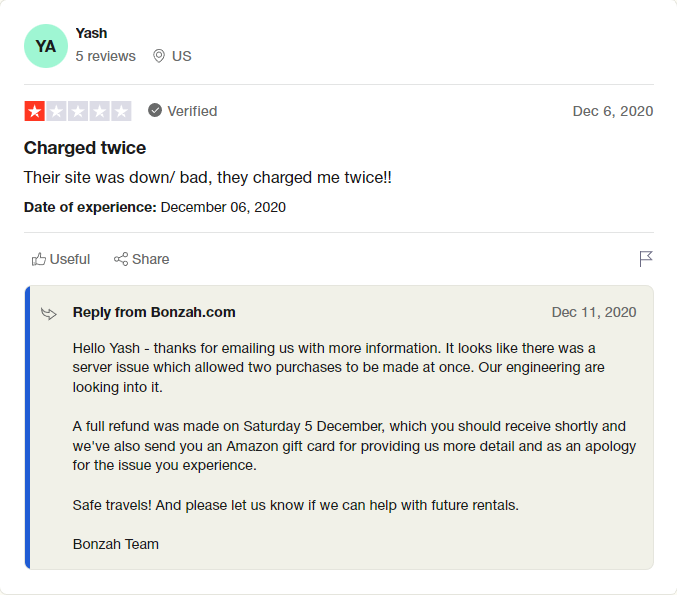

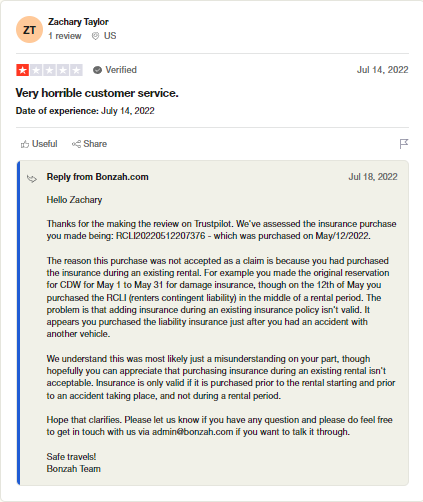

Some users, however, had unfortunate experiences with Bonzah Car Insurance. The issues encountered include:

- Slow and cumbersome processing of insurance claims and refunds,

- Denied insurance claims,

- No contact number in case of emergency,

- Confusion on some terms and conditions to claim CDW, RCLI, SLI, and PAI/PEI,

- System errors on purchasing coverage options, and

- Customer support not reachable.

Bonzah Car Insurance is committed to certainly improving its services by collecting all reviews, even bad ones. The customer support especially shines on its adequate response to all negative reviews provided by users in Trustpilot. Some actions provided by the customer support team include:

- Provide explanation to all concerns of users regarding their denied insurance claims,

- Request all necessary information from the users to resolve their concerns on coverage options and claims,

- Authorize the refund of all payments from the users who want to enforce their 10-day free look period, and

- Send Amazon gift cards to all users who were inconvenienced with the services of Bonzah Car Insurance.

Bonzah Car Insurance will continue to help you navigate any issues that may arise during your rental car experience.

Final thoughts about Bonzah Car Insurance

After taking a detailed look at Bonzah Car Insurance and its offerings, the decision boils down to one’s priorities. It offers one of the most transparent coverage options that reflects its commitment to providing good value to its customers. You can get excellent protection for an affordable price, especially with the Primary Damage Cover for only $18.95 daily. This is something you definitely don’t want to miss!

In some cases, however, Bonzah Car Insurance may not be able to provide better rates or benefits than other rental car insurance providers. But, if you are looking for reliable and thorough coverage, Bonzah is the way to go. Their customer service goes the extra mile with fast response times and availability, making it easier for potential customers to ask questions and make complaints when necessary.

All in all, Bonzah Car Insurance gives renters peace of mind knowing that they have suitable coverage during their trip. Avail the Collision Damage Warranty for your upcoming trip, and add another coverage tailored to your protection needs!

Bonzah Discount Code & Deals:

CLICK ➤ As low as $18.95/day for Primary Damage Cover

CLICK ➤ Renter’s Contingent Liability Insurance for $14.88/day